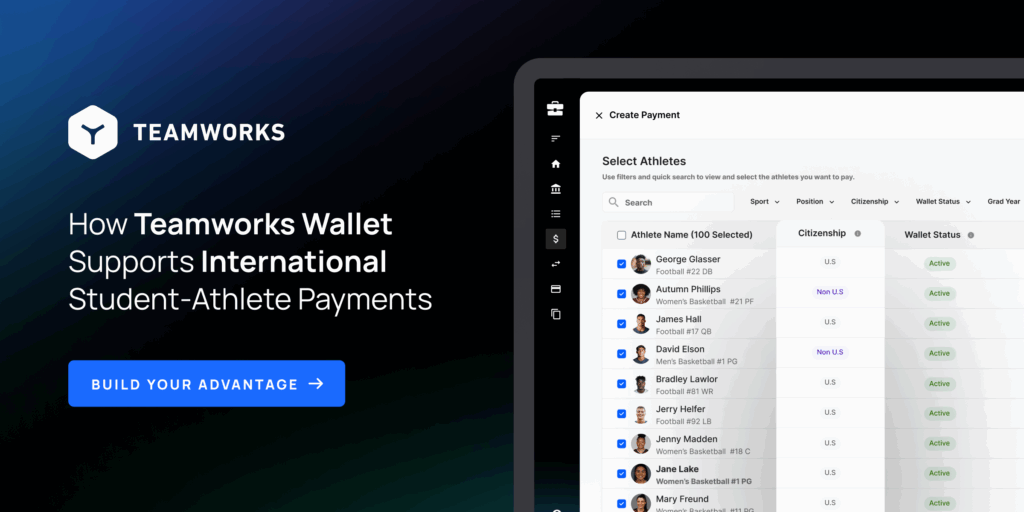

Managing payments and tax compliance as an international student-athlete in the United States presents unique challenges. But when we said we built digital banking for student-athletes, we meant all student-athletes. Teamworks is here to support your international student-athletes, providing them with a single account to receive, store, and spend their money.

Teamworks Wallet partnered with Sprintax, a global tax partner trusted by organizations like Duke University, Columbia University, Mount Sinai and more, to ensure all international student-athletes meet U.S. tax requirements and pay only what’s required—no more, no less.

Starting July 1st, 2025, international student-athletes will be eligible to receive revenue share payments directly through Wallet, with mandatory tax withholdings automatically applied based on their individual circumstances and applicable tax treaties.

The Teamworks Wallet <> Sprintax Advantage

Wallet + Sprintax gives international student-athletes a seamless, compliant way to receive rev share payments and automatically manage tax withholdings, removing barriers to participation:

- Facilitates accurate federal withholdings.

- Streamlines tax filings and documentation, handling everything from W-8BEN forms to year-end tax forms automatically.

- Ensures compliance requirements are met before payments can be processed to international student-athletes.

How It Works

During the Wallet onboarding process, Sprintax guides international student-athletes through a streamlined questionnaire that:

- Determines appropriate federal withholding rates based on tax treaty eligibility

- Generates pre-populated W-8BEN forms for both royalty and interest income

- Ensures compliance with U.S. tax regulations

Comprehensive Tax Compliance for International Student-Athletes

As the designated withholding agent, Teamworks, in partnership with Sprintax:

- Automatically determines and applies the appropriate withholding rate on payments to international student-athletes, based on their submitted W-8BEN information

- Remits withheld funds directly to the IRS

- Files all required forms, including issuing 1042-S forms to student-athletes at year-end

- Provides ongoing support in coordination with the university international student offices and Sprintax’s support team

Benefits for Universities: Streamlined Payments for International Student-Athletes

The Wallet and Sprintax partnership also provides significant advantages for athletic departments:

- Reduces administrative burden by automating tax documentation and filing

- Provides a single platform to manage payments for both domestic and international athletes

- Enhances compliance tracking and reporting capabilities

- Offers a competitive advantage in recruiting international prospects by providing a hassle-free payment solution tailored specifically for international student-athletes

Teamworks Wallet was purpose-built for student athletes, with all athletes in mind. Through our seamless digital banking solution, student-athletes can receive, store, and spend their money in one place, while our partnership with Sprintax ensures proper tax compliance without the burden of excessive withholdings.

Ready to simplify banking and tax compliance for your international student-athletes? Contact us today to learn how Teamworks Wallet can help simplify your July 1 Rev Share payments.

Teamworks Wallet does not provide 1042-S tax forms or serve as the withholding agent for payments made by third parties from the Influencer Exchange. This only applies to payments made by institutions using Teamworks Wallet for Revenue Share payments where the institution has elected Teamworks as the withholding agent. However, to ensure all tax forms are completed properly, all int’l athletes need to complete this process, regardless of the payment source.