NIL opportunities have opened new financial doors for student-athletes. As an administrator, you play a crucial role in guiding these young adults toward financial success. Here are five frequently asked questions with practical strategies to help student-athletes effectively manage their NIL earnings:

1. How can student-athletes save for taxes on NIL earnings?

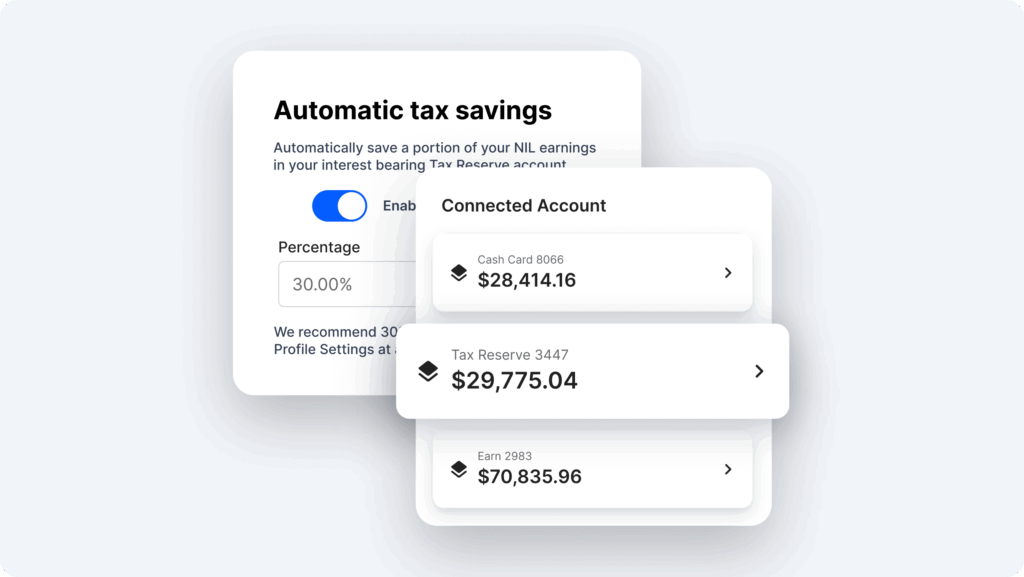

Many student-athletes may be encountering taxable income for the first time through NIL deals. Help them understand that, unlike scholarship money, NIL earnings are subject to income tax. A general rule is to set aside ~30% of earnings for federal, state, and self-employment tax; but, student-athletes should always consult a tax advisor on their specific tax liability.

Teamworks Pro Tip: A Teamworks Wallet Tax Reserves account makes it easy to save money for future tax payments automatically – while also earning interest! This simple step can prevent the scramble for money when a large tax bill arrives during filing season.

2. Why should student-athletes save NIL money?

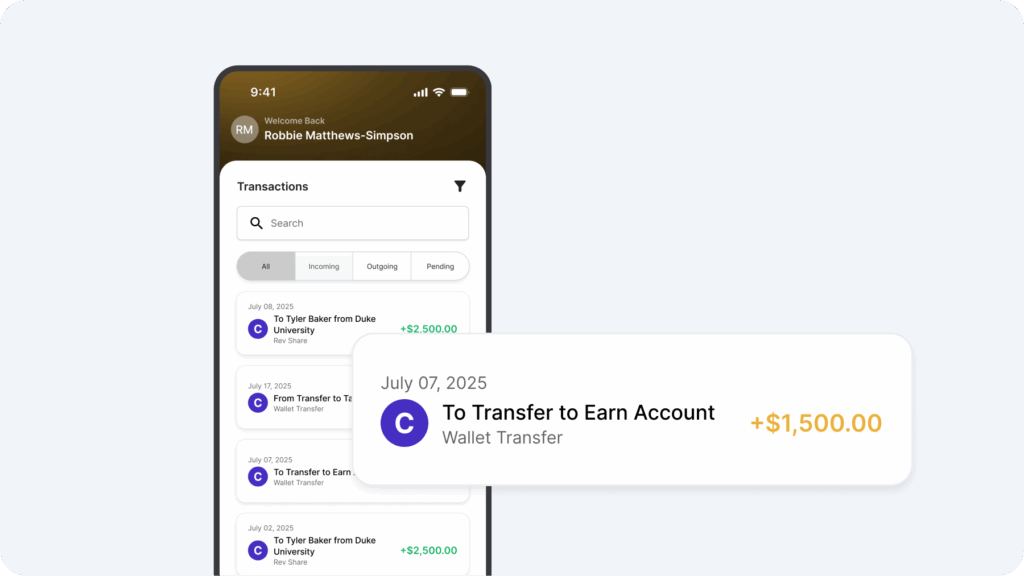

Instill the habit of long-term financial planning by encouraging student-athletes to save a portion of their NIL earnings. Explain the power of compound interest and how starting to save early can create significant financial advantages.

Teamworks Pro Tip: A Teamworks Wallet Earn Account is specifically designated for future goals and expenses, and makes it easy for student athletes to save a portion of their earnings. This separation helps create a clear distinction between spending money and savings.

3. Should student-athletes create an LLC for their NIL Deals?

For student-athletes earning substantial NIL income, establishing a Limited Liability Company (LLC) can provide tax advantages and liability protection. This business structure can also come across as more professional when negotiating with brands.

Peyton St. George, a 2022 Duke softball graduate, former Athletes Unlimited pro, and current onboarding specialist for student-athletes at Wallet, explains why student-athletes should consider opening an LLC. Watch here

Teamworks Pro Tip: Encourage student-athletes to set up a Wallet Business Account to keep business transactions separate from personal finances. This separation simplifies accounting and demonstrates financial maturity to potential partners. Consider sharing this article with athletes to help them understand why LLCs and Business Bank Accounts can help maximize their NIL money for long-term financial success.

4. What financial education resources should student-athletes use?

Financial literacy is crucial for long-term success. Provide student-athletes with educational resources about budgeting, investing, and wealth management tailored to their unique situations.

Teamworks Pro Tip: Guide student-athletes to programs like NIL Assist and Influencer’s Storyteller Playbook to build their financial knowledge. These resources offer specialized guidance for the unique financial landscape of NIL.

Find Influencer’s Storyteller Playbook in your web browser by navigating to the sidebar → Storyteller Playbook.

5. How should international student-athletes navigate NIL finances?

International student-athletes face unique tax challenges and compliance requirements. Make sure they understand how NIL earnings might affect their visa status and tax obligations both in the US and their home countries.

Teamworks Pro Tip: Leverage the Sprintax Partnership to provide specialized tax guidance for international athletes. This resource can help navigate complex international tax treaties and reporting requirements.

Empower Your Student-Athletes to Maximize NIL Potential

Help student-athletes build a solid financial foundation that extends well beyond their collegiate careers. Remember that many of these young adults are experiencing significant income for the first time, and your guidance can help transform temporary NIL opportunities into lasting financial well-being.

To recap, here are the five ways you can help your student-athletes manage their NIL finances:

- Encourage student-athletes to use a Teamworks Wallet Tax Reserves account to save money for future tax payments automatically.

- Empower athletes to establish a Teamworks Wallet Earn Account specifically designated for future goals and expenses.

- Encourage student-athletes to set up a Wallet Business Account to keep business transactions separate from personal finances.

- Guide student-athletes to programs like NIL Assist or the Influencer’s Storyteller Playbook to build their financial knowledge.

- Leverage the Sprintax Partnership to provide specialized tax guidance for international athletes.

Learn more about how Teamworks Wallet can help your student-athletes maximize their NIL.